Trump paid no taxes in 2020

January 3, 2023 - Reading time: 4 minutes

The recently released tax returns of former President Donald Trump shed light on his business losses, complicated tax arrangements, and tax payments during his tenure in office.

They are unlikely to have a major political impact on his upcoming presidential campaign, however.

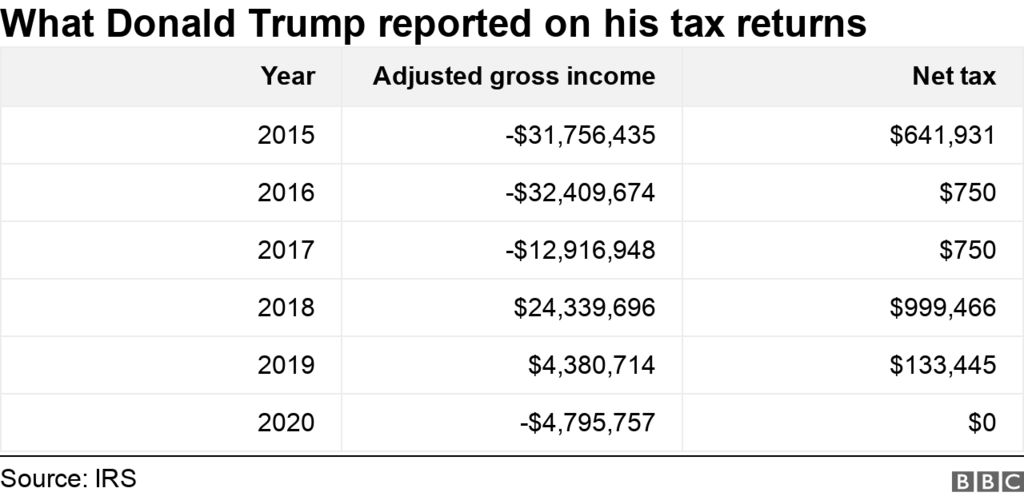

According to the documents, Mr Trump paid no federal taxes in 2020 and only $750 (£622) in 2016 and 2017 and in 2018, he paid close to $1 million.

The records were released after a long legal battle, and Mr Trump criticised the disclosure, warning that it would deepen political divides in the country.

“My returns demonstrate how successful I have been and how I have been able to create thousands of jobs and magnificent structures and enterprises through depreciation and other tax deductions,” he said.

There is no law requiring presidents to publish their tax returns, but it is a tradition.

Unlike any other worker, US presidents earn income from their own businesses and investments.

Documents released recently include tax returns and related documents for Donald Trump, the Donald J Trump Revocable Trust, and seven corporate entities.

Over 400 separate business interests were held by the former president.

Trump’s tax bill was sharply reduced by business losses, after years of effort, finally Trump’s tax returns were released.

Trump paid a total of $1.1m (£906,587) in federal income taxes from 2016 to 2019, all but $1,500 of which was paid in one year. He did not pay any taxes in 2020.

Moreover, the records show that the Internal Revenue Service, which collects taxes on behalf of the federal government, did not audit Mr Trump during his first year as president, only after Democrats requested access to his tax records in 2019.

It won’t matter what was in there at all, short of anything that would be a clear legal violation,” said Doug Heye, a former Republican National Committee spokesman. There is no Trump supporter that will say, ‘Oh, I can’t vote for him now’….even though we haven’t seen Trump’s taxes, we’ve been through it before. This isn’t changing minds.”

“Trump voters won’t be moved by anything,” said Democratic strategist Ameshia Cross.

She said undecided voters – or Republicans seeking an alternative to Mr Trump – may perceive the documents as proving his business acumen “wasn’t actually what he was making it out to be.”

She said that would mean that the entire campaign that he ran on was basically a lie. “This exposes something he had been trying to hide for years.”

What is Trump’s tax rate compared to that of other presidents?

In 2018, Trump and his wife earned $24.3m in adjusted gross income. But he paid just under $1m, giving him a tax rate of just 4.1%. In America, spouses file joint returns.

Barack Obama and Michelle Obama’s taxable income peaked in 2009 when they took home $5.5 million. Most of their income came from the sales of Mr Obama’s two books, Dreams from My Father and Audacity of Hope.

George W Bush and his wife Laura Bush averaged about $800,000. They wrote their presidential biography after he left office. On average, they had a tax rate of 27.8%. About half came from salaries, while the other half came from interest and investments.

Darren Stephenson

Darren Stephenson writing spans a wide range of topics, from in-depth political analysis to human interest stories. His unique perspective and engaging narrative style have earned him a loyal readership. Darren's commitment to journalistic integrity and his ability to connect with readers make him a standout voice in modern journalism.